- call now (678) 884-9517

- Schedule Appointment Book Now

Mr. Michael Sullivan

Former IRS Agent, Teaching Instructor, Fox and ABC News Contributor

Joshua A. Webskowski

EA, NTPI FELLOW, USTCP

Herb Cantor

CPA, Former Revenue Agent/ Appeal Agent

Peter Salinger

EA, Former IRS Revenue Officer & IRS Appeals Settlement Officer

Julie Lynch

Former IRS, Revenue Officer

Our Process

How does Turn to Tax Resolution Address your Situation?

Step 01

Initial Discovery Call Your journey to tax clarity begins with a conversation. In our initial discovery call, we dive deep into the specifics of your tax issues, ensuring we understand every detail. This personalized approach sets the stage for a tailored solution.

Step 02

Comprehensive Evaluation With a clear understanding of your situation, we embark on a thorough evaluation of your financial landscape. We consider every factor that impacts your tax position, ensuring no stone is left unturned in our quest for the best solution.

Step 03

Tailoring a Strategy Armed with insights from our evaluation, we craft a customized strategy just for you. Our solutions are designed to be both effective and feasible, perfectly aligned with your unique needs and goals.

Step 04

Implementing the Plan With a bespoke strategy in hand, we spring into action. This involves negotiating with the IRS, filing essential paperwork, and taking all necessary steps to resolve your tax issues efficiently and effectively.

Step 05

Continuous Monitoring and Adaptation Our commitment to your success doesn’t stop at implementation. We continuously monitor progress, making adjustments as needed to ensure the best possible outcome. Our flexible approach adapts to any changes, keeping your interests at the forefront.

Step 06

Resolution and Follow-Up Achieving resolution is just the beginning. We provide ongoing support and guidance to keep you on a stable financial path. Our dedication to your long-term well-being ensures that you remain confident and informed about your tax situation.

Enrolled Agent

An Enrolled Agent (EA) is a federally licensed tax professional with expertise in tax matters. EAs are authorized by the U.S. Department of the Treasury to represent taxpayers before the Internal Revenue Service (IRS) for audits, collections, and appeals.

Why Clarity Tax Resolutions LLC?

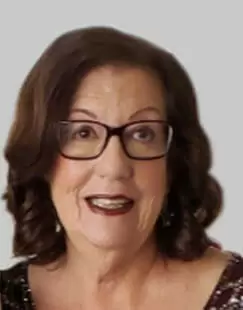

Maria Cervantes, the founder of Clarity Tax Resolutions, is a highly dedicated Enrolled Agent with over 16 years of experience in taxation. With a passion for tax law and a commitment to staying current with evolving regulations, Maria offers expert tax consulting services and representation for individuals and businesses. Her extensive knowledge covers income tax, estate tax, business tax, and international tax matters, ensuring clients receive the most favorable outcomes.

Maria’s client-centered approach focuses on personalized service, tailoring tax strategies to align with each client’s financial goals. As an Enrolled Agent certified by the IRS, she provides comprehensive services, from tax planning and compliance to resolving IRS issues. Passionate about community involvement, Maria also volunteers to help low-income individuals and promotes financial literacy through educational events. Connect with Maria for expert guidance and support in achieving your financial goals.

What We Do?

How to Remove an IRS Bank Levy

At Clarity Tax Resolutions, our team of former IRS managers and agents is dedicated to expeditiously resolving IRS bank levies and settling your case...

How the IRS Finds Your Assets

In today's digital age, the IRS uses a variety of sophisticated techniques to uncover taxpayer assets. Understanding these methods can help you stay informed and prepared...

How to Remove IRS Wage Garnishment

Approximately 1.9 million taxpayers face IRS levies every year. Understanding how to stop wage garnishments can help you regain control over your finances.

Unfiled, Back, Past Due, Late Tax Returns

At Clarity Tax Resolutions, our team’s 60+ years of combined IRS experience equips us with the knowledge and tools to simplify and cost-effectively manage your tax return issues...

IRS Trust Fund Penalty Solutions

If you're facing the TFRP, contact us today. Our expertise in IRS procedures and settlement calculations can help you effectively resolve your tax issues.

IRS Prepared My Tax Return

Did the IRS file an amended return on your behalf? Don’t let the IRS dictate your tax situation. At Clarity Tax Resolutions, we can help you correct IRS-prepared returns under IRC 6020(b)...

Stress-Free Tax Solutions

At Clarity Tax Resolutions, our nationwide team of expert tax professionals is dedicated to resolving your tax issues with precision and care. After your initial consultation, we will match your case with the most suitable and affordable expert to ensure a swift resolution. With a combined 25 years of direct IRS experience, our insider knowledge allows us to effectively tackle your tax problems, eliminating stress and worry from your life.

Need Tax Help? Let a Enrolled Agent and Expert Guide You!

IRS troubles got you down? Agents showing up unannounced? Feeling crushed by tax debt? Breathe easy—Maria Cervantes, enrolled IRS agent and master tax consultant, is on your side. Whether it’s back taxes, wage garnishments, tax levies, unfiled returns, or any other tax issue, Maria will leverage her insider expertise to swiftly get the IRS off your back and restore your peace of mind.

Beware of IRS Penalties and Actions

The IRS imposes severe penalties and high interest rates, and they have the power to seize and auction your assets. IRS revenue agents enforce these laws rigorously. Often, taxpayers mistakenly claim exemptions, deductions, or credits they aren’t eligible for. When this happens, the IRS contacts the taxpayer to correct the error. Without proper documentation, IRS settlement officers will adjust the tax return, leading to significant tax liabilities, penalties, and interest.

Licensed Enrolled Agent Today!

Explore your options and start your journey towards assured tax relief.

- call now (678) 884-9517

Maria Cervantes Licensed Enrolled Agent

Frequently Asked Questions

We offer a comprehensive range of tax solutions, including tax consulting services, tax representation, tax planning, and tax compliance. Our expertise covers income tax, estate tax, business tax, and international tax matters.

An Enrolled Agent (EA) is a tax professional certified by the IRS. EAs have in-depth knowledge of tax codes and are authorized to represent taxpayers before the IRS. Maria Cervantes, our founder, is a highly experienced EA with Over 15 years in the field.

Our team specializes in resolving IRS issues such as back taxes, wage garnishments, tax levies, unfiled returns, and more. We use our insider knowledge to negotiate with the IRS on your behalf and work towards the most favorable outcomes.

If you receive an IRS Final Notice of Intent to Levy, contact us immediately. We can act quickly to address the notice, prevent asset seizures, and develop a plan to resolve your tax issues efficiently.

Our IRS tax audit defense solutions involve reviewing your case, preparing the necessary documentation, and representing you before the IRS. We aim to minimize your liabilities and protect your interests during the audit process.

Yes, we offer tax debt settlement solutions to help reduce your financial burden. Our experts negotiate with the IRS on your behalf to secure the best possible terms for your tax debt.

Our personalized, client-centered approach sets us apart. We tailor our tax strategies to meet your unique financial goals and provide comprehensive support from planning to compliance and resolution of IRS issues. With over 250 years of combined IRS experience, our team offers unparalleled expertise.

Getting started is easy. Contact us to schedule an initial consultation, where we’ll discuss your tax needs and match you with the best expert to handle your case. We’re here to provide the guidance and support you need for effective tax management.

Yes, we provide specialized services for filing taxes in Georgia. Our tax filing consultants ensure compliance with state laws and work to maximize your refunds.

While we specialize in tax consulting services, our team includes professionals with extensive experience in tax relief. We can provide the expertise you need to address and resolve your tax issues effectively.